The Asian Cannabis Report: 2nd Edition

Business Insights into the Thai Cannabis Market

A 20-page supplement to the main report which dives deeper into Thailand's regulatory challenges, cannabis tourism, Thailand's cannabis business landscape, licensing, compliance - and more.

£290

BUY NOWMarket Sizing Data

Country-by-country market sizing forecasts (2022-2026) for cannabis markets in Asia, including: Japan, Taiwan, South Korea, Thailand, India, Malaysia, Nepal and Sri Lanka.

£790

BUY NOWMarket Sizing Data + Business Insights into the Thai Cannabis Market

Purchase both market sizing data and 20-page business insights supplement together for a complete and in-depth overview of the Asian cannabis market.

£990

BUY NOW*Please note: Market sizing analysis is not included in the free-to-download version of the report. For market sizing, please see the Premium Packages tab below.

The Asian Cannabis Report: 2nd Edition

A 20-page supplement to the main report which dives deeper into Thailand's regulatory challenges, cannabis tourism, Thailand's cannabis business landscape, licensing, compliance - and more.

Country-by-country market sizing forecasts (2022-2026) for cannabis markets in Asia, including: Japan, Taiwan, South Korea, Thailand, India, Malaysia, Nepal and Sri Lanka.

Purchase both market sizing data and 20-page business insights supplement together for a complete and in-depth overview of the Asian cannabis market.

*Please note: Market sizing analysis is not included in the free-to-download version of the report. For market sizing, please see the Premium Packages tab below.

Overview

Cannabis is undergoing a process of re-liberalisation in Asia, where the damaging drug control policies, which have been pushed for decades, are receding in favour of more sensible, supportive and economically sound policies. While full legalisation is underway across much of North America and Europe, the legalisation of cannabis and its derivatives is occurring more gradually in Asia.

The health and financial benefits of cannabis legalisation in North America are serving as an example to governments in Asia, and across the world, that the prohibition of cannabis is no longer a politically justifiable position to maintain. This is convincing more and more governments in Asia to reapraise their national drug strategies.

COVID-19 was a catalyst for cannabis adoption during the pandemic, with countries, such as India noting increased usage among its citizens to combat stress and anxiety during challenging times. Cannabis is also seen as a new economic opportunity for many countries following the global lockdown, when the economy, exports and travel were brought to a standstill. Cannabis promises a brand new industry which will generate billions of dollars for several countries in the world in the near future. While this opportunity exists now, competition from many regions is increasing, and countries seeking to export, need to carefully consider the number of competitors, as well as supply and demand balances in target markets.

Thailand is at the leading edge of cannabis liberalisation in South East Asia. The region decriminalised medical cannabis in 2018 and the country then decriminalised cannabis plant parts in a push towards commercialisation in June 2022. For a full exploration of cannabis liberalisation in Asia in Thailand see the Business In-sights into the Thai Cannabis Market Report available alongside this report.

Medical cannabis is seeing a renaissance on the continent,supported in several regions by interest in traditional medicines and the ability to produce new pharmaceuticals based on traditional formulas. While hemp is still being cultivated widely for fibre and textiles, CBD is making headway in just a few nations, like Japan and India.

While countries such as India, South Korea, China and Japan still face regulatory hurdles from their respective governments, there are burgeoning opportunities for commercialisation in exports and even loopholes that allow for certain businesses to operate and thrive.

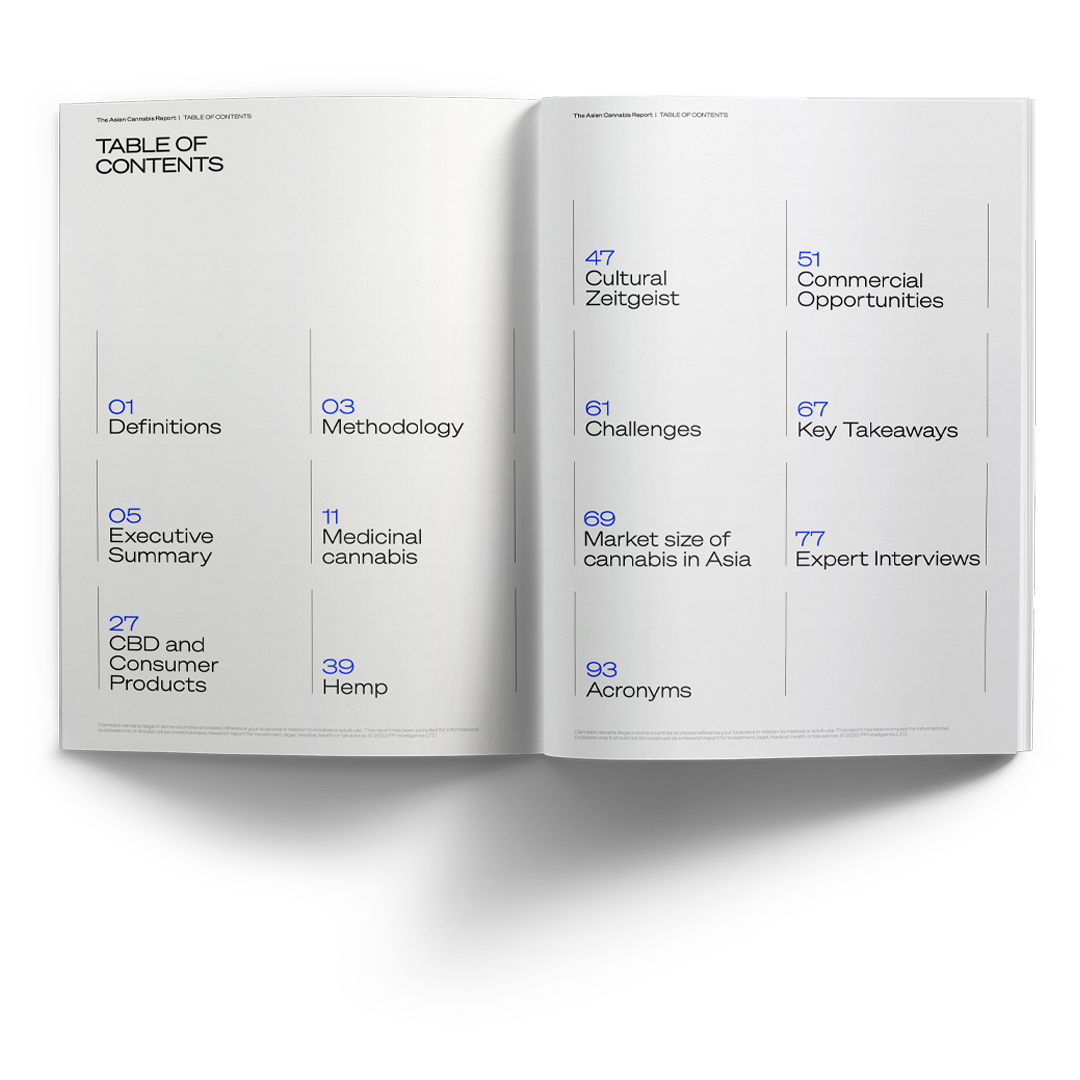

Medicinal cannabis

Cannabis has long held a place in traditional Asian medicine. The region itself is heavily influenced by its large Hindu and Buddhist religions, all of which have integrated the traditional use of cannabis to some extent, particularly in healing and medical usages. The medicinal cannabis markets reviewed in this report are:

- Thailand

- India

- China

- South Korea

- Japan

- Malaysia

- Taiwan

- Sri Lanka

- Nepal

- Philippines

- Bhutan

CBD and Consumer Products

Cannabis CBD infused products have seen a sharp increase in demand in Asia, reflecting shifting attitudes and demands for consumers. In this report, we explore CBD & Consumer Products for the following nations:

- Thailand

- China

- Hong Kong

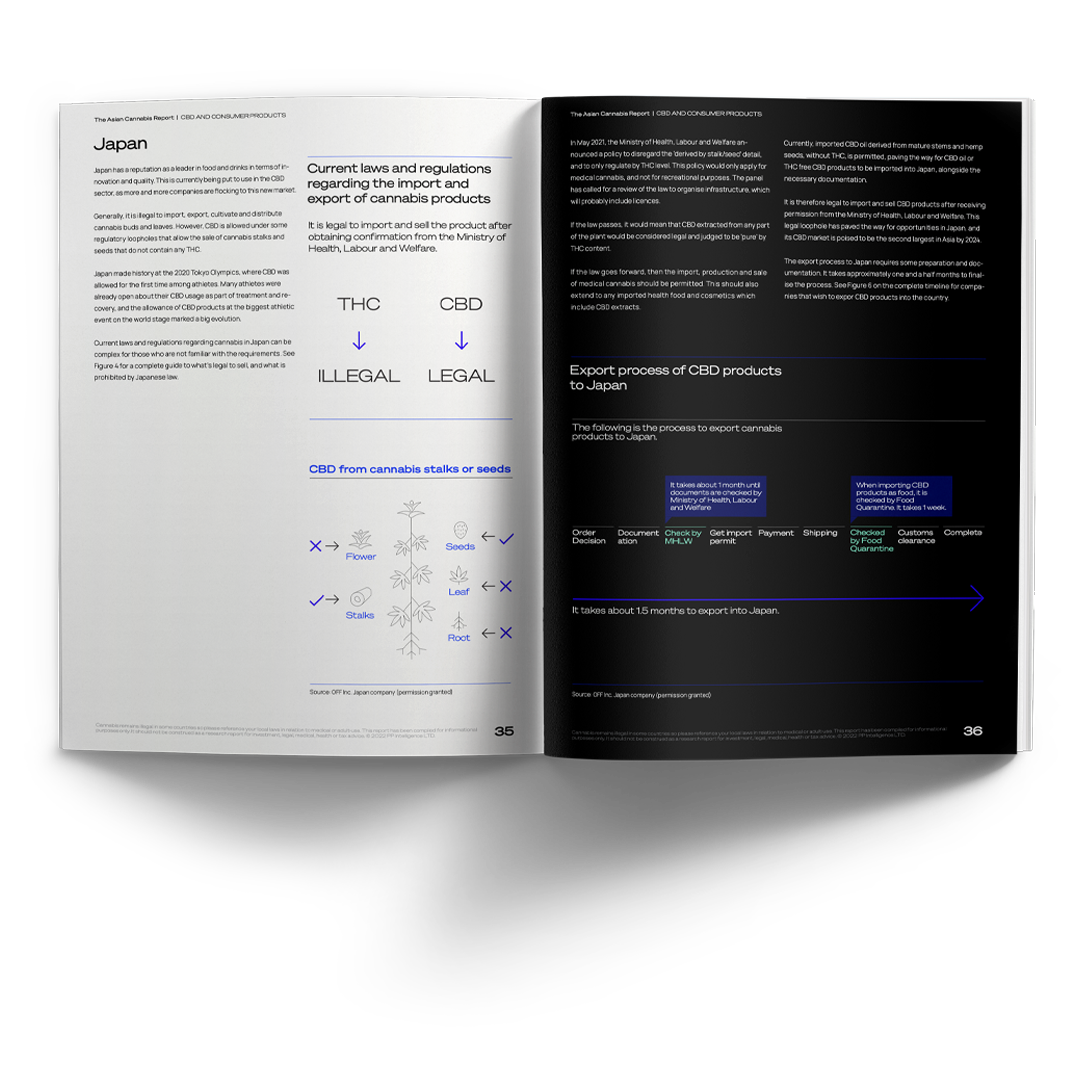

- Japan

- India

- South Korea

- Vietnam

Hemp

Hemp is an industry and stands on its own in countries across Asia, with a long history of usage dating back milenia. We explore the following countries concerning hemp:

- Thailand

- India

- South Korea

- China

- Japan

- Malaysia

- Vietnam

- Pakistan

Cultural zeitgeist

The general attitude regarding cannabis, CBD and hemp is changing rather significantly across Asia, and the industry is gaining momentum from the public, as more people recognise its various uses and benefits. We showcase the countries who are championing this sentiment such as:

- Thailand

- India

- Japan

- Others

Commercial opportunities

Business opportunities are increasing in tandem with the rise of interest in cannabis in Asia. From opportunities in medical tourism, wellness and mental health treatments, morebusinesses are seeing the commercial value in cannabis- driven businesses. We explore the following countries benefiting from this, including:

- Thailand

- India

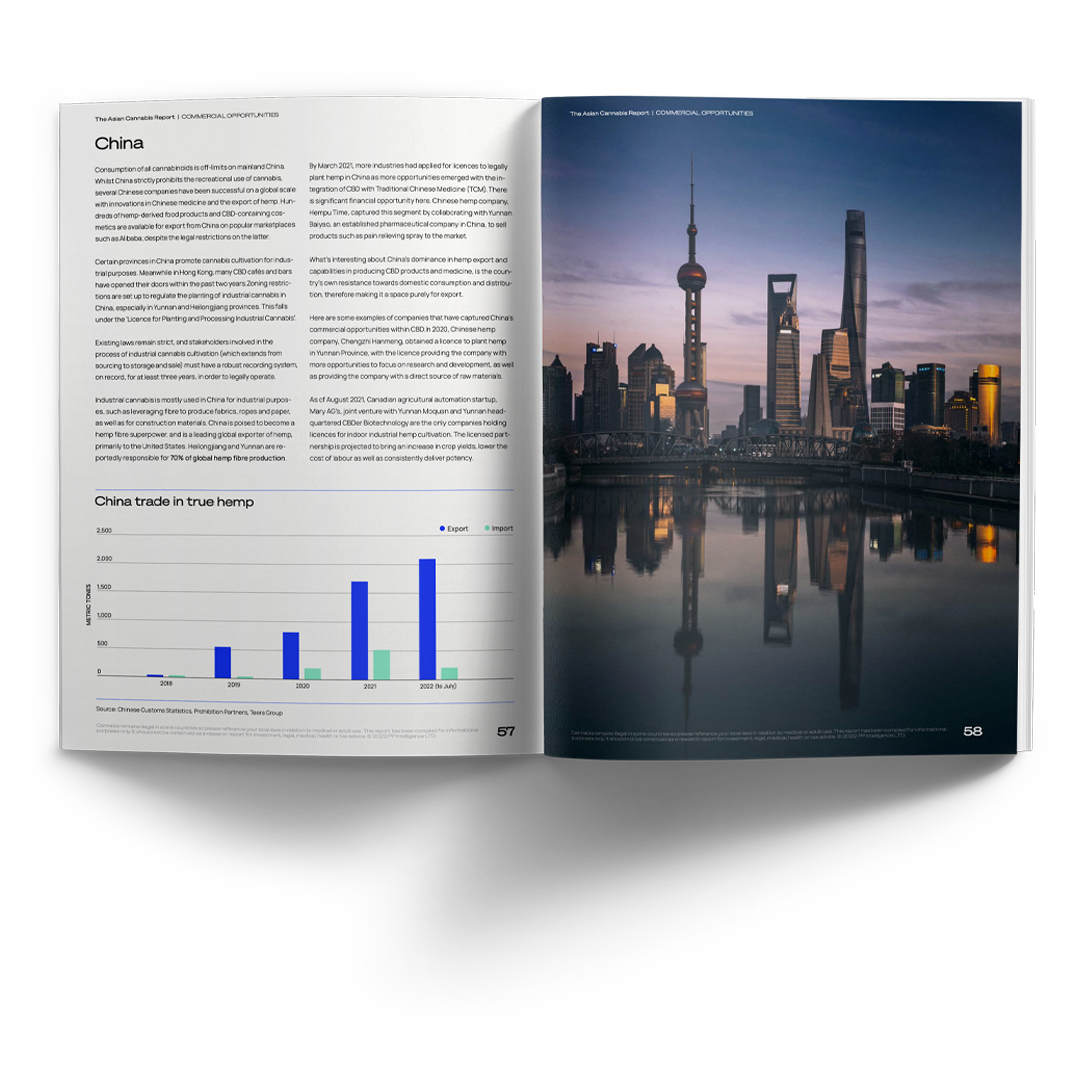

- China

- Japan

- South Korea

- Nepal

- Singapore

- Bhutan

Challenges

Regulatory roadblocks, laws and government policies are key barriers to the cannabis industry in Asia. No Asian country has formally legalised cannabis for recreational purposes. We explore the rules and regulations governing the following nations:

- Thailand

- India

- China

- South Korea

- Japan

- Malaysia

- Taiwan

Expert Interviews

- Michelle Wilder & Luc Richner, Cannavigia

- Dr Anunchai Assawamakin, Ministry of Public Health

- Dr Pakakrong Kwankao, Chao Phya Abhaibubejhr Hospital

- Nadon Chaicharoen, TEERA Group

- Nuntakan Suwanpidokkul, Government Pharmaceutical Organisation

- Jahan Peston Jamas, BOHECO

- Toshihiko Ito, Japan Cannabidiol Association

- Yen-Ho Lai (Dr Kiang), Cannabis Advocate

- Andrew Lee, CBD Lab Asia

Key Findings

- While countries such as India, South Korea, China and Japan still face regulatory hurdles from their respective governments, there are burgeoning opportunities for commercialisation in exports and even loopholes that allow for certain businesses to operate and thrive.

- Cannabis has long held a place in traditional Asian medicine. The region itself is heavily influenced by its large Hindu and Buddhist religions, all of which have integrated the traditional use of cannabis to some extent, particularly in healing and medical usage.

- Cannabis CBD infused products have seen a sharp increase in demand in Asia, reflecting shifting attitudes and demands from consumers.

- Hemp is an industry and stands on its own in countries across Asia, with a long history of usage dating back millennia.

- The general attitude regarding cannabis, CBD and hemp is changing rather significantly across Asia, and the industry is gaining momentum from the public, as more people recognise its various uses and benefits.

- Business opportunities are increasing in tandem with the rise of interest in cannabis in Asia. From opportunities in medical tourism, wellness and mental health treatments, more businesses are seeing the commercial value in cannabis- driven businesses.

- Regulatory roadblocks, laws and government policies are key barriers to the cannabis industry in Asia. No Asian country has formally legalised cannabis for recreational purposes.

- The cannabis industry in Asia has significant untapped commercial potential, together with deeply rooted historical uses of hemp and cannabis variations; the region is shaping up to be a unique and exciting landscape.

Package 1 - Business Insights into the Thai Cannabis Market - £295

This additional 20-page report includes: Thailand's regulatory challenges, cannabis tourism, Thailand's cannabis business landscape, licensing and compliance and public companies and financials for Asia's most cannabis friendly country.

Package 2 - Market Sizing Data - £795

This data bolt-on includes market sizing forecasts up until 2026, a country-by-country breakdown of growth, and a description of the driving forces behind growth in key markets.

Package 3 - Market Sizing + Business Insights into the Thai Cannabis Market - £990

Purchase both the Market Sizing and Business Insights into the Thai Cannabis Market packages in a single bundle, for the most comprehensive understanding of the emerging Asian and Thai cannabis markets.

As Trusted By

Insights

on the global cannabis industry

International Cannabis Weekly newsletter brings you the most important developments, news and informed commentary on the global cannabis industry. Join our community of 80,000+ subscribers.