The Cannabis Extraction Report

The Cannabis Extraction Report

- Due to the growing transition away from medical flowers and towards extracted products, Europe is expected to see an exponential increase in sales for medical extract-based finished products (without marketing authorisation), with sales expected to reach €1.5 billion (US$1.8 billion) by 2024.

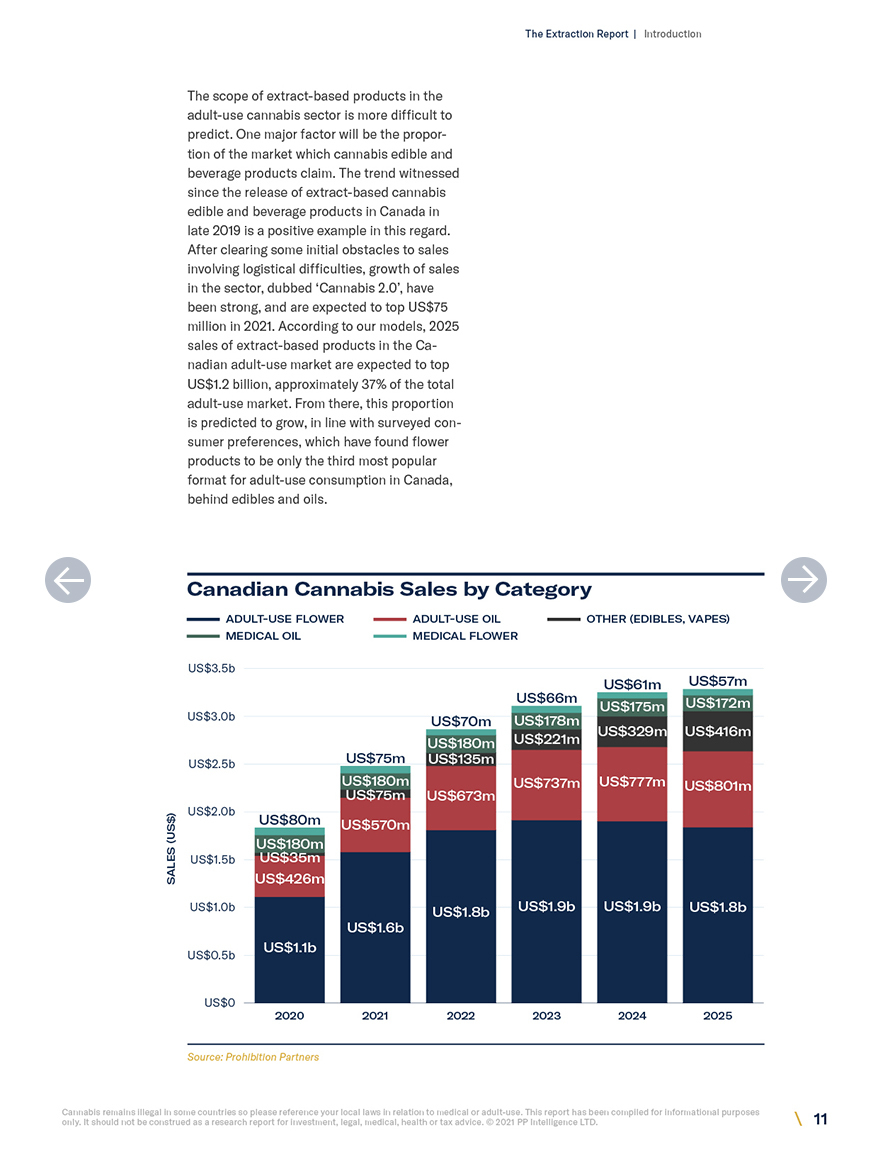

- By 2025, sales of extract-based products in the Canadian adult-use market are expected to top US$1.2 billion, approximately 37% of the total adult-use market. From there, this proportion is predicted to grow, in line with surveyed consumer preferences.

The cannabis extraction industry is growing and diversifying at a rapid pace. This is necessary in order to keep up with the constantly evolving government regulations and consumer demands across the globe. As this occurs, innovation in methods and technologies are pushing the boundaries of what is expected from extraction processes in terms of efficiency, precision and pricing. Cannabis and hemp products are increasingly becoming commoditised, which is fuelling the development of diverse forms of extracts for products such as vapes, oils and edibles.

At the early stages of the market, extraction facilities for cannabis were primarily operated by vertically integrated cannabis companies. However, as the industry has developed over the years, there has been an increase in specialist extractors who use their expertise to develop new techniques and methods to produce extracts for specific sectors. The supply chain is now more diverse than ever.

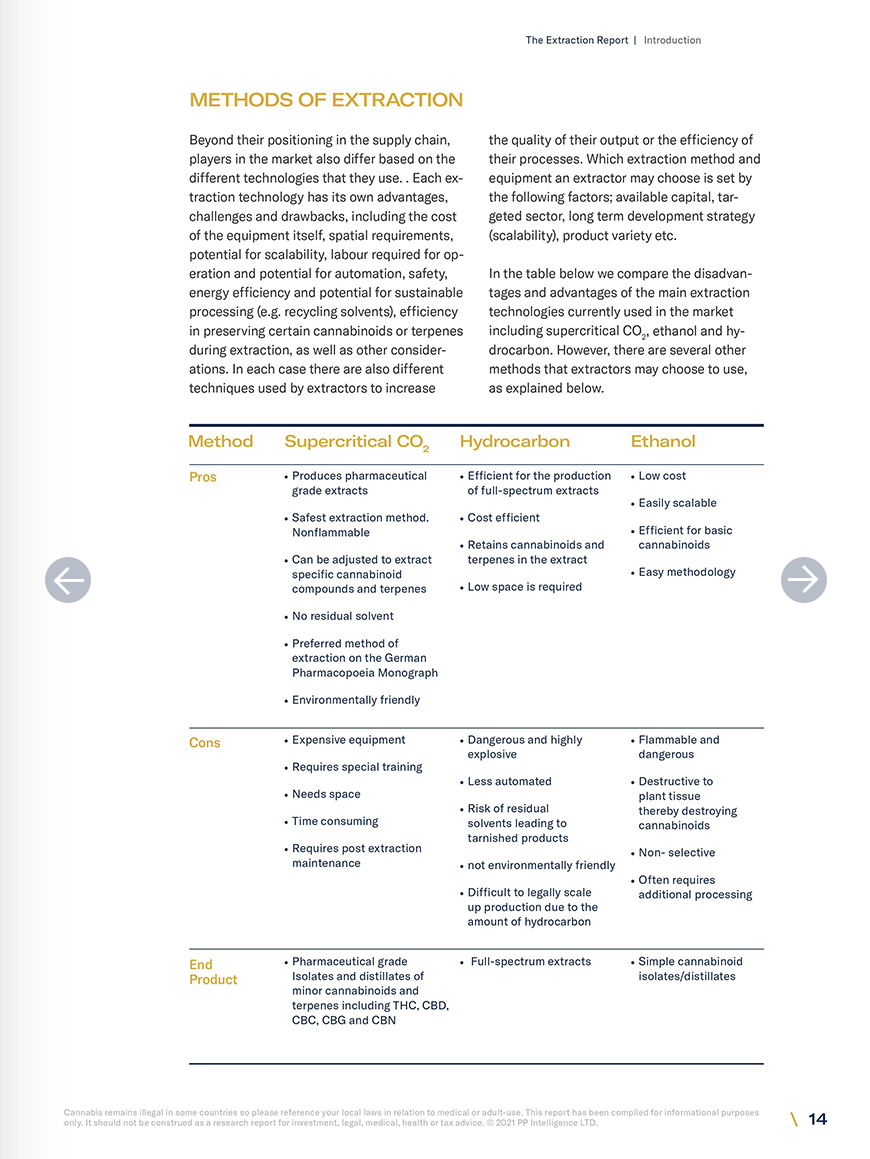

The methods of cannabis extraction are continuously developing with companies seeking various ways to target specific compounds while focusing on cost efficient, safe and scalable extraction methods to stay competitive in the market.

The North American extraction markets are the most mature markets today; however, Europe is witnessing growth as supply chains are becoming more robust and extract demand is on the rise. Both markets still hold a set of significant challenges and barriers to entry in terms of; regulation, distribution channels, capital costs, access to capital and a lack of expertise.

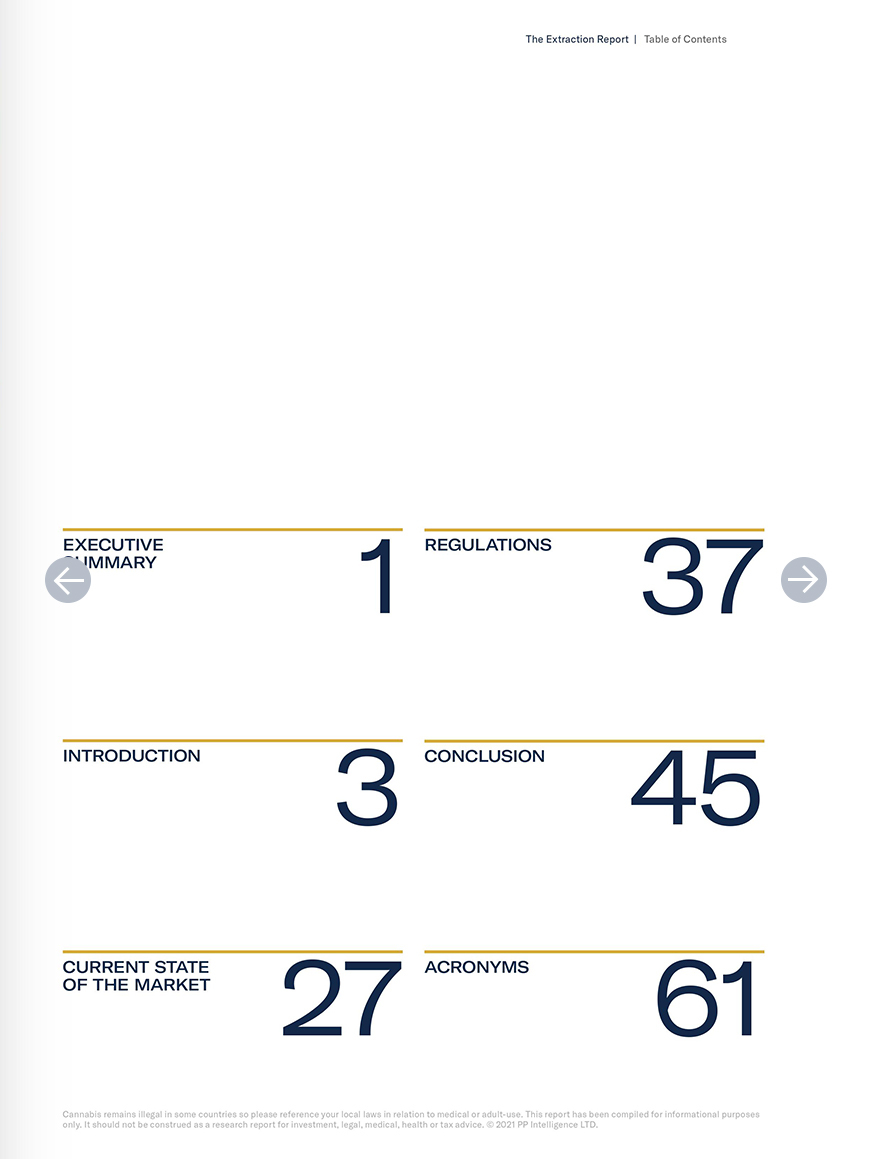

- Stages of Extraction

- Types of Extracts

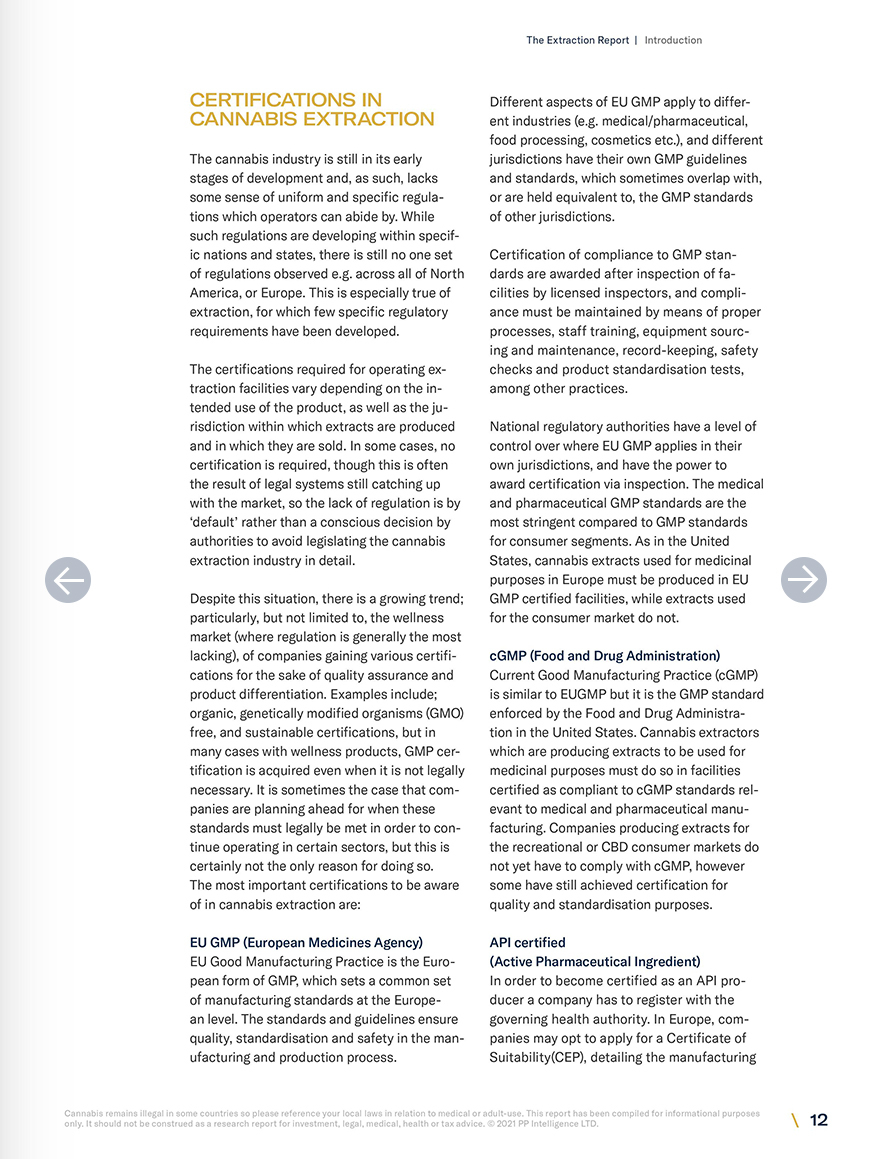

- Certifications in Cannabis Extraction

- Methods of Extraction

- Supply Chain

- Current State of the Market

- Regulations

- Conclusion

- Expert Interviews

- Expert Interviews from Emerging Markets

- Alcohol Extraction

- Hydrocarbon Extraction

- Supercritical CO₂ Extraction

- Hydrodynamic Extraction

- Industrial Scale Centrifugal Partition Chromatography

- Rosin Press

- Ultrasound Assisted Extraction

- Enzyme Assisted Extraction (EAE)

- Medical and pharmaceutical products

- Wellness

- Adult-use

- Growth of adult-use and medical extracts

- Large Extraction Specialists

- Mid-Small Scale Extractors

- Vertically Integrated Companies

- Specialised API Producers

- Industrial Extractors (Non-Cannabis Specialists)

- Canadian Regulatory Framework

- US Regulatory Framework

- Adult-Use and Medical

- US CBD Regulations

- European Regulations - Medical Cannabis

- European Regulations - CBD

- European Cannabis Extraction Market

- North American Cannabis Extraction Market

- United States

- United Kingdom

- Canada

- Germany

- Austria

- Switzerland

- Spain

- Portugal

- Netherlands

- Italy

As Trusted By

Insights

on the global cannabis industry

International Cannabis Weekly newsletter brings you the most important developments, news and informed commentary on the global cannabis industry. Join our community of 80,000+ subscribers.