The European Cannabis Report: 6th Edition

This report takes an in-depth look at the progress of cannabis legalisation across Europe, the trade flows on the continent, the business opportunities, the medical products on the market and the patients who use them. We also consider how COVID-19 has affected the market in Europe and what this means for the year ahead. 2020 was a huge year for cannabis in Europe and around the globe. The fourth quarter of 2020 in particular saw several important developments. In November, the European Court of Justice ruled that CBD is not to be considered a narcotic substance under EU Law. Weeks later, the UN finally recognised the medical potential of cannabis by removing the plant and its derivatives from Schedule IV of the Single Convention on Narcotic Drugs. We estimate that over 60,000 people were able to access cannabis medications for the first time in Europe during 2020, bringing the total to 185,000 patients accessing medical cannabis treatment in the region during the year. Overall, we estimate the value of the market for medical cannabis to be worth €230.7 million as of the end of 2020. Further, we expect the value of European cannabis to grow with a CAGR of 67.4%, to reach €3.2 billion in 2025. Our approach to forecasting the European cannabis industry has its foundation in the database of historical data points (sales, patients, volumes, imports, prices etc.), available in Atalis. As the patient access to medical cannabis advances across Europe, so too do the opportunities for businesses to embed themselves in niches of the value chain, before the market becomes more established. The European Cannabis Report: Sixth Edition is designed to support businesses in doing so, along with the conferences offered by Prohibition Partners Live as well as our Consulting services for cannabis and psychedelic ventures.

The European Cannabis Report: 6th Edition

This report takes an in-depth look at the progress of cannabis legalisation across Europe, the trade flows on the continent, the business opportunities, the medical products on the market and the patients who use them. We also consider how COVID-19 has affected the market in Europe and what this means for the year ahead. 2020 was a huge year for cannabis in Europe and around the globe. The fourth quarter of 2020 in particular saw several important developments. In November, the European Court of Justice ruled that CBD is not to be considered a narcotic substance under EU Law. Weeks later, the UN finally recognised the medical potential of cannabis by removing the plant and its derivatives from Schedule IV of the Single Convention on Narcotic Drugs. We estimate that over 60,000 people were able to access cannabis medications for the first time in Europe during 2020, bringing the total to 185,000 patients accessing medical cannabis treatment in the region during the year. Overall, we estimate the value of the market for medical cannabis to be worth €230.7 million as of the end of 2020. Further, we expect the value of European cannabis to grow with a CAGR of 67.4%, to reach €3.2 billion in 2025. Our approach to forecasting the European cannabis industry has its foundation in the database of historical data points (sales, patients, volumes, imports, prices etc.), available in Atalis. As the patient access to medical cannabis advances across Europe, so too do the opportunities for businesses to embed themselves in niches of the value chain, before the market becomes more established. The European Cannabis Report: Sixth Edition is designed to support businesses in doing so, along with the conferences offered by Prohibition Partners Live as well as our Consulting services for cannabis and psychedelic ventures.

PARTNERS

OVERVIEW

KEY FINDINGS

Data Packages

Key Findings

- The European cannabis market will be worth €403.4 million by the end of 2021. We expect the market to grow with a CAGR of 67.4% from 2021 to reach €3.2 billion by 2025.

- By the end of the forecast period, we expect several nations to introduce legal access to adult-use cannabis including Netherlands, Switzerland, Germany and others. We estimate these sales could be worth over €500 million by 2025.

- We predict Germany will constitute over half of the European market until 2024 and will be worth over €840 million by the end of the forecast period. By 2025, large countries like France and the UK will have developed their patient access considerably and will represent a significant share of the European market.

Methodology

- Atalis

- Market Research

- Market Sizing

- Medical cannabis Sizing

- Adult-Use Sizing

Executive Summary

- Executive Summary

Trends

- The March of Legalisation

- Timeline: Medical and Adult-Use Recreational cannabis Legislation Throughout Europe

- The Different Phases of Medical Legislation

- Adult-Use Legalisation

- Criminal Offences per cannabis User/ Year

- Luxembourg Cautiously Leading the Way

- The Netherlands Experiment

- The Roadmap to the Supply Legalisation Trial

- Switzerland

- City Wide Trials and Social Clubs

- Development of Supply Chain

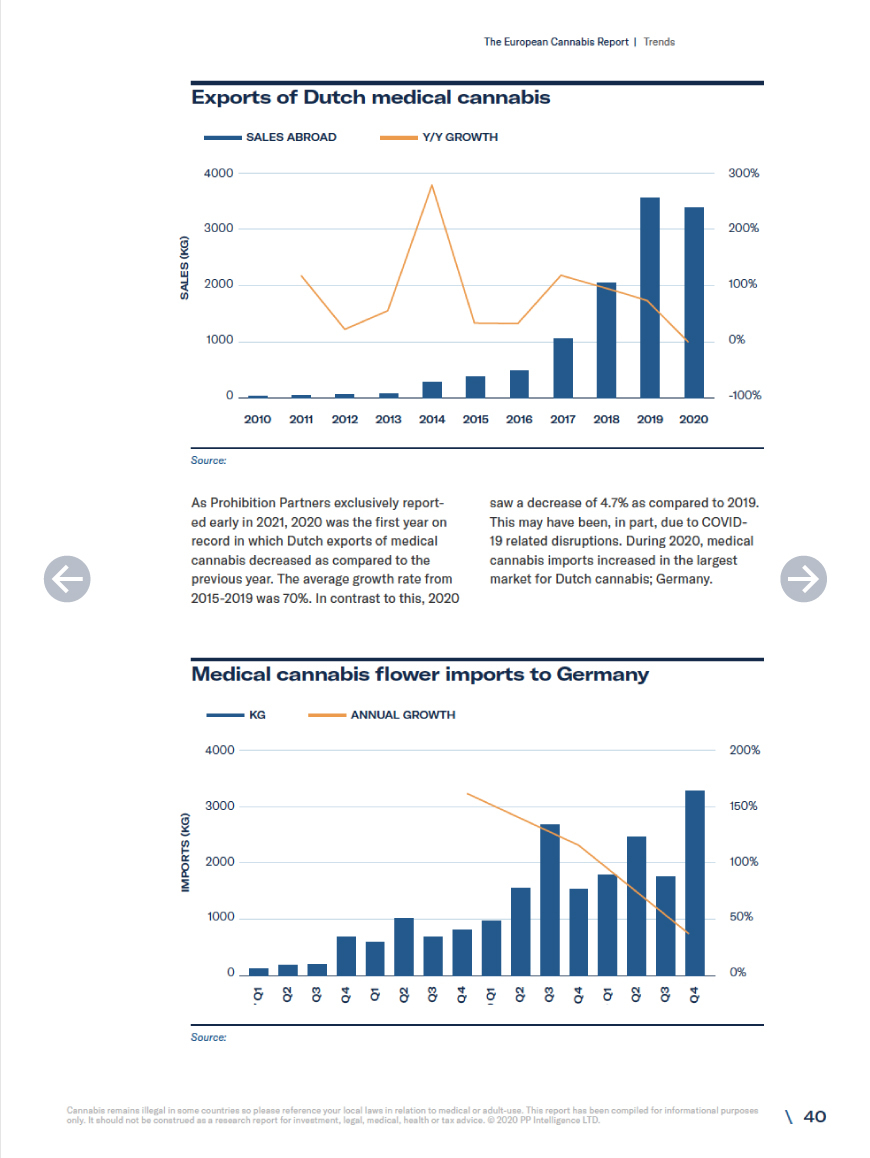

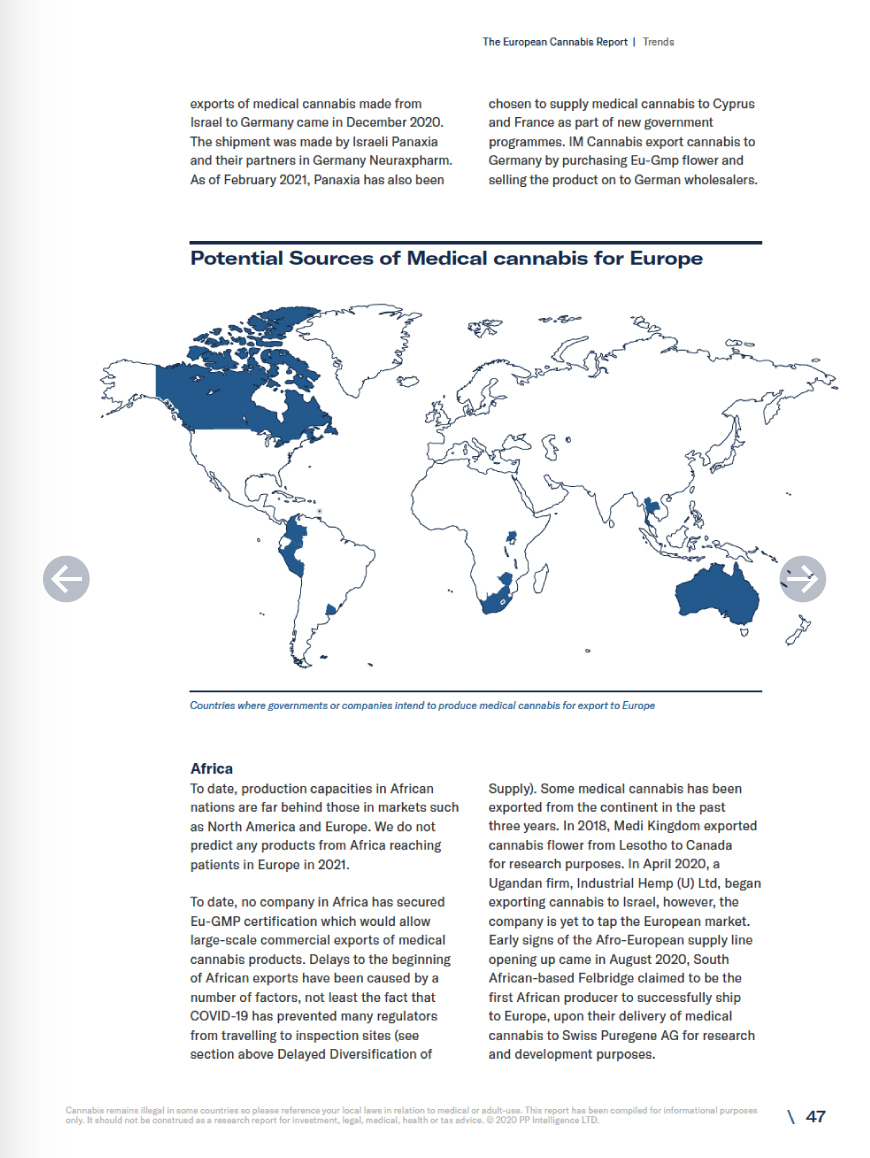

- The Delayed Diversification of Supply

- Challenges to the Dutch/ Canadian Duopoly

- Imports to the EU

- Alternative Supply Chain Emerging

- Domestic Production

- Intra-European Trade

- Development of Ancillary Services

- Product Format: The Trend Towards Extracts and Isolates

- The Market for Flowers

- COVID-19

- European Stock Exchanges

- CBD

- Regulations

- CBD vs Epidolex

Who Are The Medical Cannabis Patients

- Indications

- Demographics

- Gender

- Who are the Prescribers

Market Sizing

- European cannabis Market Size

- Medical cannabis sales in Europe

- Sales of Adult-Use cannabis in Europe

Countries in Focus

- Germany

- Denmark

- The Czech Republic

- Italy

- France

- The Netherlands

- Poland

- The UK

- Switzerland

As Trusted By

Insights

on the global cannabis industry

International Cannabis Weekly newsletter brings you the most important developments, news and informed commentary on the global cannabis industry. Join our community of 80,000+ subscribers.