The European CBD Report: Health & Wellness

The European CBD Report Health and Wellness + Market Sizing Data

Prohibition Partners also offers projections for European CBD market through market sizing data package, which will give you further insight into:

- Sales of CBD in Europe, by country

- Data on CBD users in Europe, by country

- Sales of CBD in Europe by product type

£495

BUY NOW*Please note: Market sizing analysis is not included in the free-to-download version of the report. For market sizing, please see the Premium Packages tab below.

The European CBD Report: Health & Wellness

Prohibition Partners also offers projections for European CBD market through market sizing data package, which will give you further insight into:

- Sales of CBD in Europe, by country

- Data on CBD users in Europe, by country

- Sales of CBD in Europe by product type

*Please note: Market sizing analysis is not included in the free-to-download version of the report. For market sizing, please see the Premium Packages tab below.

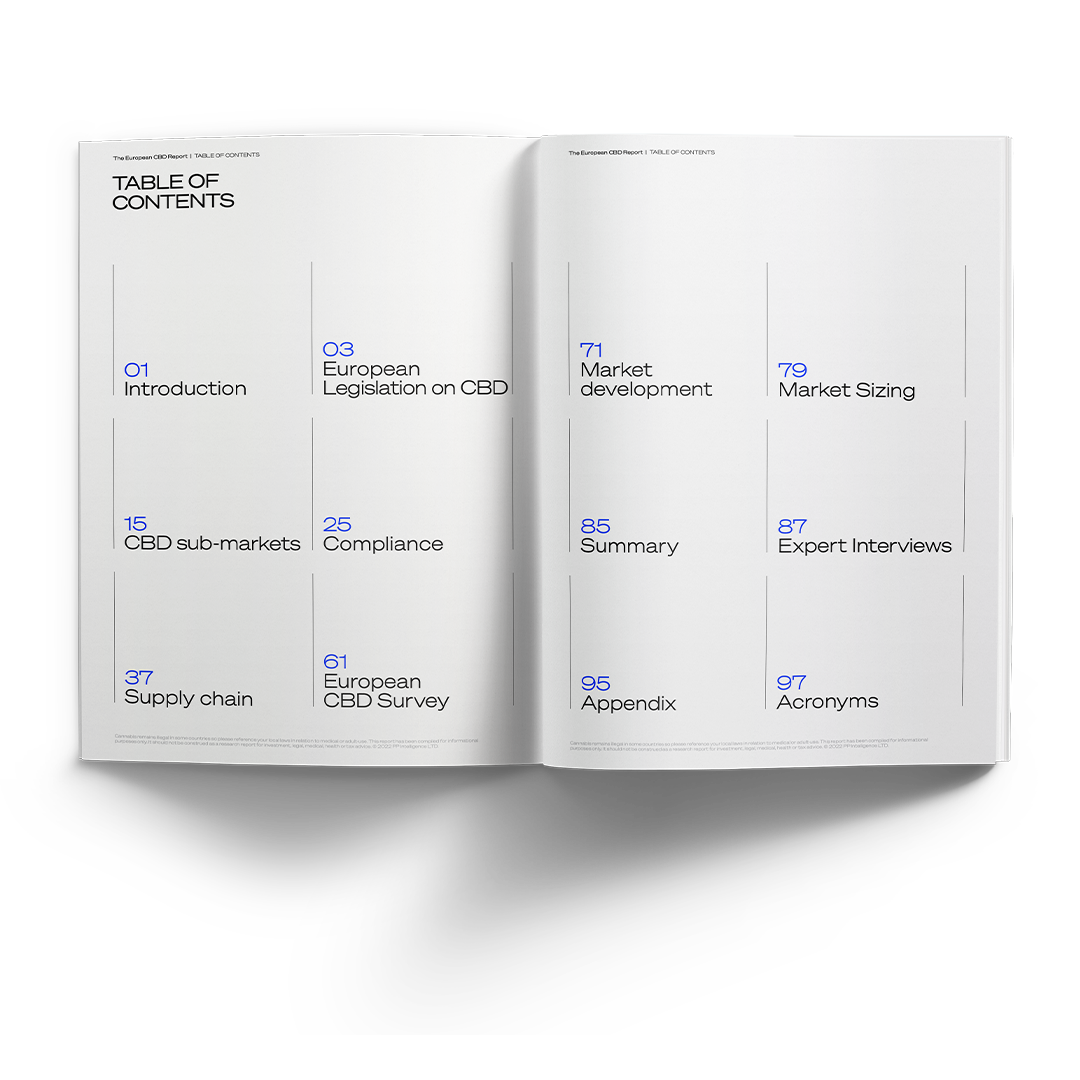

Overview

CBD is now one of the most popular wellness products in Europe, with about 11% of respondents to Prohibition Partners' new European survey indicating some usage over the past 12 months. CBD-specific ‘bricks and mortar' stores are popping up in virtually every country on the continent and the industry is generating hundreds of millions of euro in revenue each year. However, the legislative and regulatory environment that guides this market is extremely changeable and heterogenous across Europe. Operators need to be acutely aware of these changes as they are driving the business opportunities on the continent.

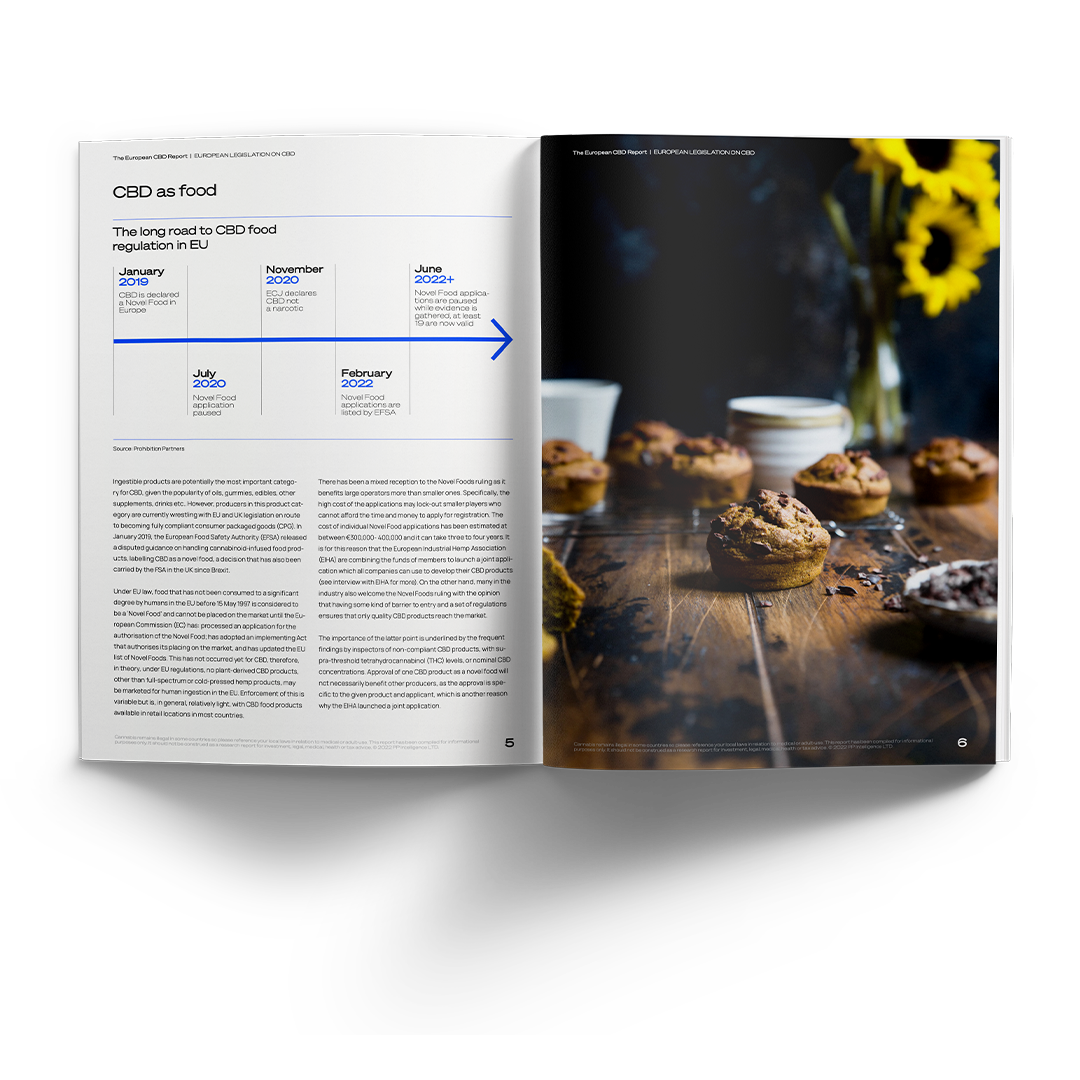

Legislation

Legislation for CBD in Europe is currently fragmented and insubstantial in terms of the legal system in most individual countries. While some rules have been adapted from those pertaining to hemp cultivation, in many cases, specific regulations for CBD products have not yet been established. This has meant that many groups have held off developing their CBD business while others have accepted a high level of risk by operating in an extremely uncertain legal environment.

CBD Sub Markets

CBD is treated differently by regulators depending on the intended use of the product. This is one of the reasons why products in each category differ hugely in terms of; their availability to consumers, the way they are made and the price that they are eventually sold for. Below, we outline some of the major distinctions between the different types of CBD products in Europe.

Compliance

Compliance for CBD in Europe can be a maze of international, EU, national and sub-national legislation as well as a heterogeneous mix of enforcement policies. For example, in Germany, the authority for the recognition of a CBD product as Novel or not, relies, not with the EU nor German regulators, but at the level of individual provinces. At the EU level, the most common category of CBD products are virtually all being sold under legally dubious conditions, as the vast majority of operators who have been doing business for years, ignore the Novel Foods status of CBD in favour of continuing their previous business practice while the assessments are carried out.

Supply chain

European CBD survey

For the purposes of this report, Prohibition Partners surveyed 5,234 people across Germany, the United Kingdom, Spain, Italy, Poland, France and the Netherlands. CBD usage is common in Europe Overall, the prevalence of past-year CBD product usage, in surveyed European countries, is quite high. Of the 5,234 people surveyed across Europe, 11% have used a CBD product in the last 12 months. An additional 4% of respondents have used CBD at some point in their lives but not in the past 12 months. CBD products are now very well known across the continent, with just over half of the people surveyed having at least heard of CBD products. This is being fuelled by better knowledge about the safety and effectiveness of CBD products e.g. for wellness purposes in terms of anxiety, sleep issues and pain conditions.

Market Development

Key Findings

- CBD is now one of the most popular wellness products in Europe, with about 11% of respondents to Prohibition Partners' new European survey indicating some usage over the past 12 months.

- In November 2020, the European Court of Justice (ECJ) declared that CBD cannot be considered a narcotic substance under the European Union (EU) interpretation of the United Nations Single Convention on Narcotic Drugs (UNODC).

- The next major step for CBD in the EU and the United Kingdom (UK) is the acceptance of CBD products into the Novel Food Catalogue, under each jurisdiction.

- The supply of CBD into Europe is currently able to meet the market demands, and there is very likely an oversupply in terms of the raw material.

- The cultivation of hemp for CBD across Europe is still popular, especially in hubs such as the Baltic nations, Italy, Switzerland and the Netherlands. However, producers have been competing with imports from the United States (US) which massively expanded in 2019.

- CBD consumer practices in Europe are changing quite rapidly, and as CBD has no international trading codes, and most companies are operating in a legally ‘grey' space, there is a dearth of data on consumption patterns.

- Specific laws and regulations for CBD are lagging far behind the evolution of the market, meaning CBD is now potentially the largest CPG product in Europe which is, in the majority, sold under legally ‘grey' conditions.

Package 1 - Report + Market Sizing Data - £495

Prohibition Partners also offers projections for all key European CBD markets through our market sizing data package, which will give you further insight into:

- Sales of CBD in Europe, by country

- Data on CBD users in Europe, by country

- Sales of CBD in Europe by product type

As Trusted By

Insights

on the global cannabis industry

International Cannabis Weekly newsletter brings you the most important developments, news and informed commentary on the global cannabis industry. Join our community of 80,000+ subscribers.